Alibaba Group (NYSE: BABA)

|

| The company's headquarters in Hangzhou, Zhejiang province, China |

Quick Stats (Last 10 years)

- Revenue has multiplied 35 times (4,5x since 2017)

- The operating margin has decreased substantially (from 50% to 15%, remains stable for the last 3 years)

- EPS (30%-40% yearly growth)

- Shares Outstanding - an average yearly increase under 3%

- ROI has been decreasing remaining stable for the last three years 8%-9%

- ROE stable last 5 years (14,5%-19%)

Summary

Alibaba Group Holding Limited provides technology infrastructure and marketing reach to merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. Incorporated in 1999. It operates through four segments:

- Core Commerce

- Cloud Computing

- Digital Media and Entertainment

- Innovation Initiatives

|

| China's e-commerce market share (2018) |

- Economies of scale

- Network effect

- Greater Operating Margin than Amazon

- (15% vs 5%)

- Monopoly tendency (>50% Chinese market)

*All businesses should aim to become a monopoly, as allows them to set their prices and stay in the business for very prolonged periods. However, if the Chinese government keeps pushing with anti-monopoly policies, it can affect negatively the future FCF.

Competitors

- Here we should consider Amazon as its biggest competitor as both companies have the same core business model. Taking into account the growth rate (EPS) in a period of seven years on levels prior to COVID-19 (2013-2019). AMZN did perform better growing at a CAGR of almost 70%, on the other hand, BABA grew at a CAGR of 25%. Both results are outstanding but Amazon is the big growth winner here.

- However, looking into the Net Income at the end period, we can appreciate that BABA has two times AMZN's Net Income, which means that the company should be able to generate with more ease a greater FCF. As mentioned before this is given the low operating income of AMZN

- On the other hand, AMZN right now is much more developed and powerful in the cloud business.

- Both companies are growing at substantial rates, but BABA has still a long run to be where is currently AMZN

- Regarding the PE Ratio, AMZN (67,90) vs BABA (19,97).

|

| BABA: (2019-2020): 62% growth (2020-2021): 50% growth AMZN: (2018-2019): 40% growth (2019-2020): 29% growth Year Ended Period: AMZN 2020 December 31 // BABA 2021 March 31 |

|

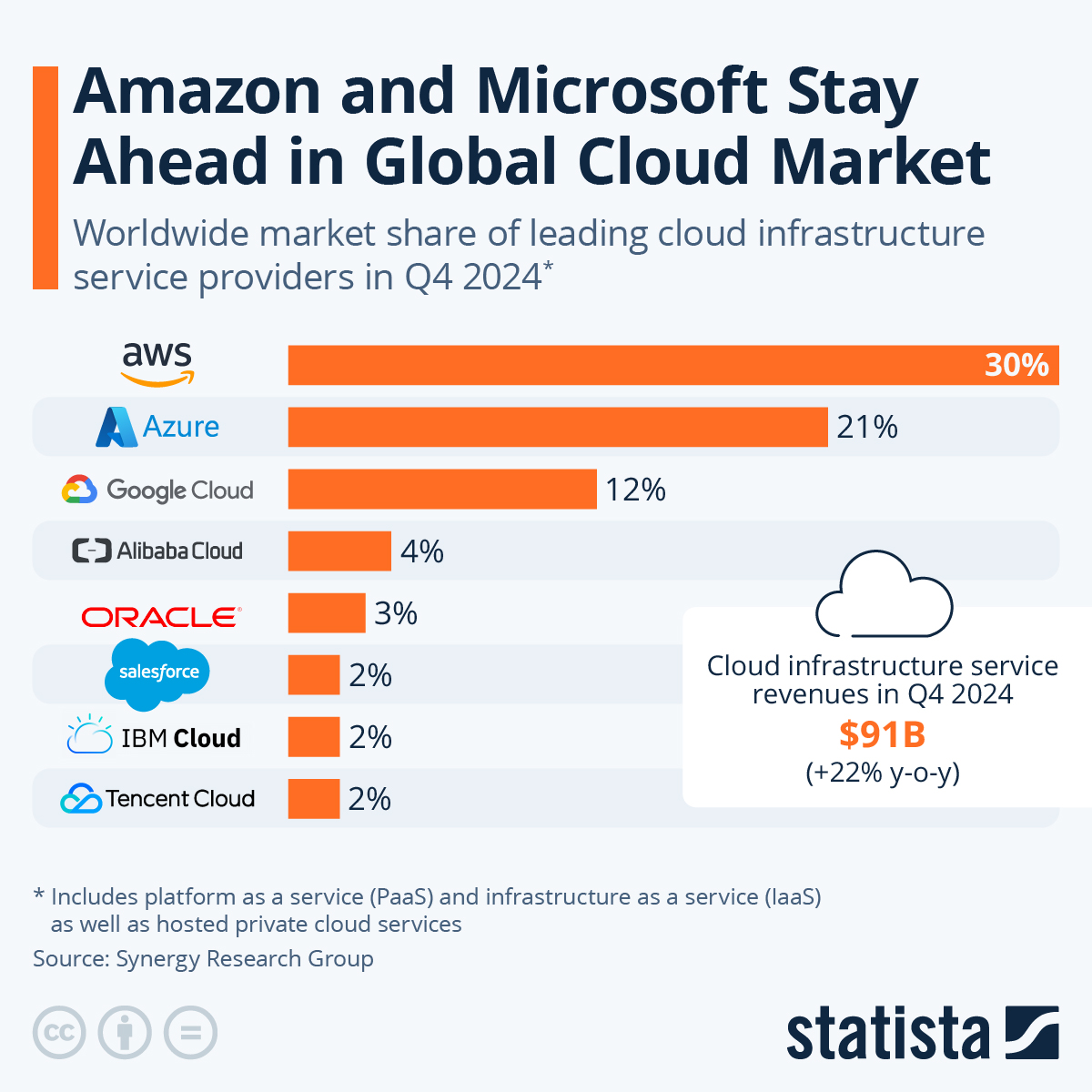

| Global Cloud Computing market share (2021) |

Financial Summary by Segments

Year Ended Period: AMZN 2020 December 31 // BABA 2021 March 31

|

| Year Ended Period: AMZN 2020 December 31 // BABA 2021 March 31 |

Executive Team

It is interesting to see how in the 2020 annual report Jack Yun Ma's position was "Founder and Director" with a stake of 4,8%. However, in the 2021 report he appears as "Partner" and does not appear in the main shareholders table.

Main Shareholders

- Joseph C. TSAI (Executive Vice Chairman): 38M shares owned (1,4% of total) = $6,3B

- Rest of Directors and Executive Officers: 62M shares owned (0,9%)

- SoftBank (Holding Company ): 5,4B shares (24,8%)

- In 1999 made a $20M investment in the small startup Alibaba in exchange for 24,9% equity

- Jack Yun Ma (Founder) in the 2020 annual report appeared with a 4,8% equity

In 2021, salaries and benefits (excluding equity-based grants) were $46M to the directors and executive officers as a group. Additionally, share-based awards of $458.000.

Risks vs Opportunities

Let's begin with the risks involved and the negative market sentiment;

Over the last year, the market value of BABA has fallen by almost 40%, these are the following reasons why the market has such a negative sentiment about the company.

- On October 24 2020 in Shanghai, Ant Groupwas ready to launch the world's biggest IPO on the stock exchange but was suspended by government officials due to "recent changes" in regulations.

- Ahead of this, Ma addressed an assembly of high-profile figures with a controversial speech that criticised the Chinese financial system. After that, Jack Ma wasn't seen publicly for about six months.

- On April 10, China fined a record $2.8 billion after a monopoly probe found that the company had abused its dominant market position.

- And more recently we have the fact of Evergrande's (second largest Chinese real estate developer) risk of defaults on its large amounts of debt ($300 billion), there is a great worry as if the defaults continue, the entire Chinese economy might be in danger, consequently the world's economy.

- Throughout the year we've seen in the news several times headlines regarding the possibility of BABA being delisted from the NYSE, due to a change in the accounting regulations that affect foreign corporations .

- Additionally, we can take into account the increasing tensions between China and the U.S in the last few years.

On the other hand, there are several positive factors regarding the current situation of the company;

- China is the largest internet market in the world and its middle class is rapidly growing.

- Zalada (owned by Alibaba) is the second-largest e-commerce in the South East Asian market

- Expected 25% market growth until 2025

- Cloud Business segment is just taking off (became profitable on Feb 2021)

- If the company is delisted in the NYSE investors will have to buy shared from the HKEX (Hong Kong Stock Exchange) by the ticker 9988.

- CCP (Chinese Communist Party) has stayed in power for a century thanks to their encouragement to pursue economic growth and prosperity for their people. We have to understand that China has an authoritarian government combined with a free-market economy, as one of their leaders said "It doesn't matter wether the cat is black or white, so long as it catches mice". This short phrase may reflect why the wouldn't tier down its largest tech giant.

- The fines and the suspension of Ant Group's IPO were just gestures from the government to Jack Ma showing who has the control, if the relations between the government and the company are good most of the risks involved in this stock are just noise that allow us to buy at a discount price.

Now let's have a look at the company's fundamentals to see if the price reflects the real value of this asset.

Valuation

Three possible scenarios:

- Optimistic: Revenue growth (25%), Operating Margin (15%), Forward Multiples (slightly higher than 5-year average)

- Standard: Revenue growth (20%), Operating Margin (12,5%), Forward Multiples (5-year average)

- Pessimistic: Revenue growth (15%), Operating Margin (10%), Forward Multiples (Lower than 5-year average)

Conclusion

- Great growth company with strong financials, still has long growth run.

- Underpriced due to the negative sentiment of the market for the last year.

- The company is performing better that one year go but is priced at a 40% discount. If business keeps doing well and the world's economy doesn't collapse tomorrow this should be a great investment opportunity.

- Next Earnings Release on November 18

Comments

Post a Comment